Key Takeaways

- Commercial real estate can help to diversify your portfolio, increase your monthly cash flow, and get you closer to achieving your financial freedom dreams.

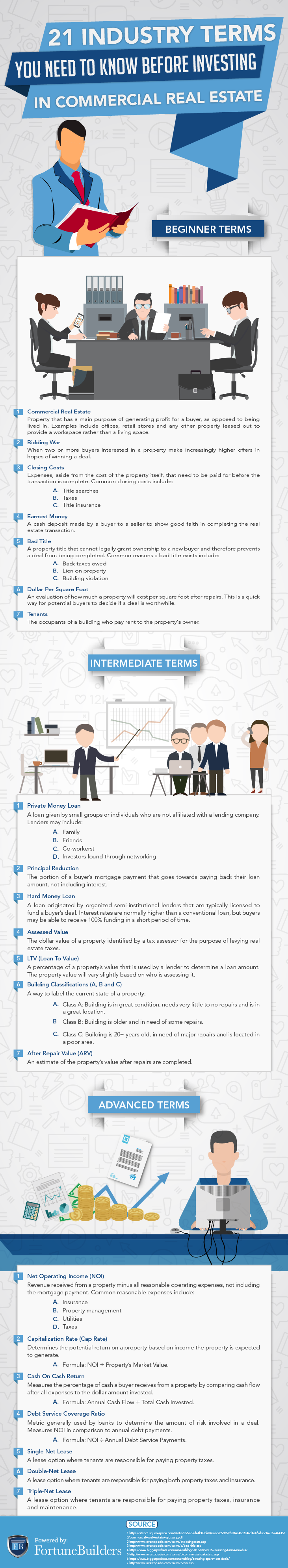

- Closing costs are expenses, aside from the cost of the property itself, that need to be paid for before the transaction is complete. Common closing costs include title searches, taxes, and title insurance.

- A bidding war is when two or more buyers interested in a property make increasingly higher offers in hopes of winning a deal.

Investing in commercial real estate is a great way to take your career to the next level. Whether you’re entirely new to the industry or you’ve had some experience with residential real estate, commercial real estate can help to diversify your portfolio, increase your monthly cash flow, and get you closer to achieving your financial freedom dreams.

When you first embark on your commercial real estate career, you’ll probably be bombarded with questions like, “Have you ever invested in commercial real estate?” and “What is your capacity to buy this property?” Don’t let this kind of negativity stand in the way of your investing goals. Instead, view those words as a challenge to motivate you to succeed.

Investing In Commercial Real Estate Like A Pro

The worst thing you can do as a new commercial investor is sound like have no experience. If you’re asking questions like “how do I calculate cap rate?” or “what is cash on cash?”, no one, from your private lender to your contractor, will take you seriously.

All you have to do is review these 21 industry terms, and you’ll be wheeling and dealing with the pros (along with profiting big) in no time.