Key Takeaways

- Investing in multifamily real estate can increase your monthly cash flow and help to diversify your portfolio .

- Multifamily investment properties are typically easier to manage due to the fact that all your tenants reside under one roof.

- Working with a CPA is strongly suggested when investing in multifamily real estate so that you can get the tax breaks you deserve.

Have you ever asked yourself, “how can I take my investing career to the next level?” If so , your answer is by buying multifamily real estate.

Aside from helping you diversify your investment portfolio and achieve your goals of future financial freedom, buying multifamily real estate has some incredible benefits. To get you excited, lets start by naming a few:

- Increased cash flow. Other than the obvious (increased number of tenants = increased cash flow), adding unique amenities can help boost your profits. One simple example: a coin operated laundry area to entice potential renters and put more money in your pocket. You will be able to pay off the machines quickly and everything else will be yours for the taking.

- Awesome tax benefits. When you provide housing to the citizens of a community, the government will thank you by offering significant tax breaks. There are a number of different items that depreciate in a multifamily unit – great for seeing tax gains. Just be sure to work with a CPA to ensure you are getting as much money back as you deserve.

- Easier to manage. When you have a number of different single family rental properties throughout a community, you are forced to traipse all across town on a regular basis (you may even need to hire multiple property managers. When you have all your tenants under one roof, things become increasingly easier to manage.

Buying Multifamily Real Estate: How To Get Started

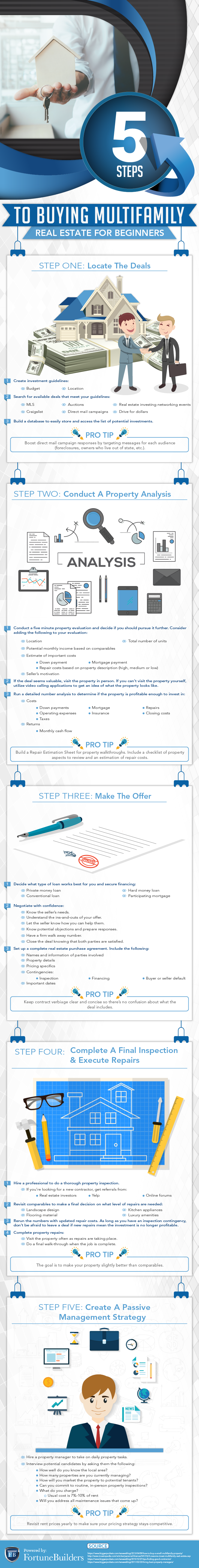

Now that we’ve convinced you that buying multifamily real estate is a must, use our infographic as a blueprint for getting started finding deals: