The Cedar Rapids real estate market has done everything in its power to put the latest recession in the rearview mirror. For the better part of a decade, real estate in Cedar Rapids has been able to improve its outlook, including the latest setback created by the pandemic. While it still has a ways to go, encouraging improvements have been put in motion to lay a strong foundation for the future of the Cedar Rapids real estate market.

Like everywhere else, values have risen in the wake of three particular indicators: lower interest rates, competition, and a distinct lack of available housing. While not unique to Cedar Rapids, these three indicators have combined to lift prices in the local housing market. As a result, the city has seen demand grow in the face of recent appreciation, which bodes well for everyone, especially investors. That said, the Fed’s latest attempt to increase interest rates will impact demand moving forward, which begs the question: Is the Cedar Rapids real estate market a good place to invest in real estate?

Let’s look at what the latest move by the Federal Reserve means for real estate investors in the Cedar Rapids real estate market.

Cedar Rapids Real Estate Market 2022 Overview

-

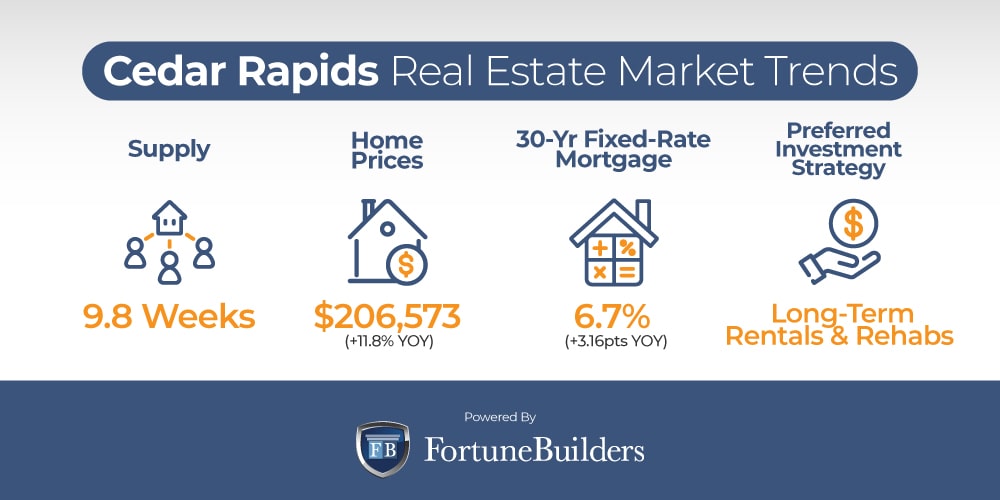

Median Home Value: $206,573

-

Median List Price: $211,633 (+10.9% year over year)

-

1-Year Appreciation Rate: +11.8%

-

Median Home Value (1-Year Forecast): -0.7%

-

Weeks Of Supply: 9.8 (-2.6 year over year)

-

New Listings: 81 (-13.8% year over year)

-

Active Listings: 696 (-40.5% year over year)

-

Homes Sold: 78 (-19.6% year over year)

-

Median Days On Market: 10 (-41 year over year)

-

Median Rent: $973 (+15.6% year over year)

-

Price-To-Rent Ratio: 17.69

-

Unemployment Rate: 3.4% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 136,467 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $60,787 (latest estimate by the U.S. Census Bureau)

-

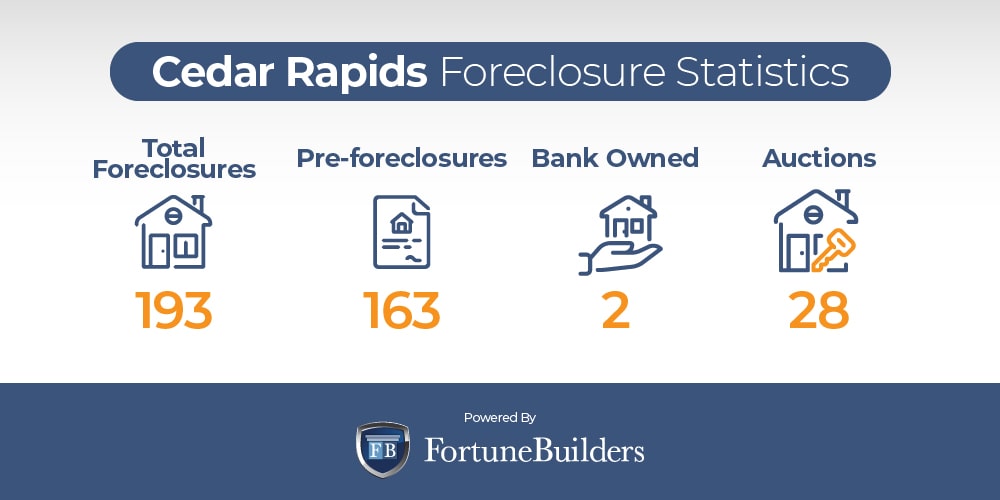

Total Active Foreclosures: 193

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Cedar Rapids Housing Market Trends 2022

Today’s Cedar Rapids housing market trends are directly correlated to the impacts of COVID-19 on the local real estate sector and the Fed’s latest moves to mitigate another housing crisis. More specifically, indicators in the Cedar Rapids real estate market are the result of both microeconomic and macroeconomic stress points. Consequently, the Fed’s latest decision to increase interest rates has dramatically shifted how the Cedar Rapids real estate market operates. The change in dynamics has culminated in the following trends:

-

Supply Trends: There are currently about 696 homes listed on the Cedar Rapids housing market. If homes continue to sell at their current pace, today’s inventory will last about 9.8 weeks. At that rate, Cedar Rapids’ inventory most likely won’t be able to keep up with demand. Supply is expected to increase as higher mortgage rates keep more buyers away, but borrowing costs also prevent more homeowners from listing; they don’t want to trade their current rates for new ones. As a result, inventory levels are expected to increase, but at a relatively slow pace for the foreseeable future.

-

Home Price Trends: Price activity in the Cedar Rapids real estate market mirrors that of the national market. Prices have risen for the better part of a decade, with the fastest pace taking place over the last two years. A distinct lack of supply and relatively low mortgage rates spurred a lot of buying activity when supply couldn’t keep up. As a result, competition drove up home values at a historic pace. Moving forward, activity is expected to slow from higher mortgage rates, but competition will remain intact and drive prices up at a slower pace.

-

Interest Rate Trends: Mortgage rates have risen steadily for the better part of 12 months. However, the Fed’s latest attempt to combat inflation has witnessed a historic increase in rates. More than doubling year-to-date, the average commitment rate on a 30-year fixed-rate mortgage is just south of seven percent. The increase has already decreased mortgage applications in the Cedar Rapids real estate market and should continue to do so as long as the Fed keeps tightening.

-

Investor Trends: Years of appreciation have driven most Cedar Rapids real estate investors to invest in long-term rental properties. Low borrowing costs enabled investors to offset higher acquisition costs and increase monthly cash flow. With prices near record highs, the rental exit strategy remains viable, but the recent increase in foreclosures suggests investors may start looking at flips and rehabs again. On the rise, foreclosures may allow investors to buy homes below market value and flip for a generous profit.

Cedar Rapids Median Home Prices 2022

The Cedar Rapids housing market currently boasts a median home value of $206,573. Today’s price represents about a decade’s worth of appreciation. At this point in 2012, the median home value in Cedar Rapids was about $140,325; that means the city’s median home value has increased 47.2% in ten years. It is worth noting, however, that home values have appreciated the fastest during the pandemic. Since COVID-19 was officially declared a global pandemic, real estate in Cedar Rapids has appreciated an average of 25.6%.

Cedar Rapids has seen its median home value appreciate significantly in a relatively short period. During the pandemic, price increases resulted from supply and demand; there weren’t enough homes to keep up with the demand brought about by lower interest rates. That said, inventory is expected to increase shortly—albeit slowly.

Housing activity is expected to slow due to higher interest rates and a looming recession. However, homeowners are slowly losing their firm grasp over the local market. At the very least, the Cedar Rapids real estate market is less of a seller’s market than in the past. As a result, prices will continue to rise throughout 2022, but may eventually drop once the Fed tightens even more.

Cedar Rapids Foreclosure Statistics 2022

According to ATTOM Data Solutions, a leading curator of real estate data nationwide for land and property data, there were 34,501 U.S. properties that entered into the foreclosure process in August; that’s up 14% month-over-month and 118% year-over-year.

“Two years after the onset of the COVID-19 pandemic, and after massive government intervention and mortgage industry efforts to prevent defaults, foreclosure starts have almost returned to 2019 levels,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “August foreclosure starts were at 86 percent of the number of foreclosure starts in August 2019, but it’s important to remember that even then, foreclosure activity was relatively low compared to historical averages.”

Foreclosures have been increasing over the course of 2022. “Lenders started the foreclosure process on 23,952 U.S. properties in August 2022, up 12 percent from last month and up 187 percent from a year ago,” according to ATTOM Data Solutions. As a result, the Iowa real estate market had the seventeenth highest foreclosure rate in August. According to RealtyTrac, the Cedar Rapids real estate market is responsible for 193 of the state’s most recent foreclosures.

Cedar Rapids Real Estate Market Forecast 2022

Any Cedar Rapids real estate market forecast for 2022 will largely rely on the previously discussed trends. If for nothing else, it is impossible to know where the local market is heading without knowing where it came from. That said, today’s trends play a large role in the following forecast:

-

Home Values Will Rise: In the past, supply and demand constraints lent themselves to higher home prices; today, the same indicators are still at play. There aren’t enough listings to keep up with the competition. However, rising interest rates and a lack of sellers have already decreased mortgage applications. As a result, competition persists, but not at the same level as in the past. Looking forward, prices will keep rising but at a slower pace. As the Cedar Rapids real estate market gets further into next year, prices may even start to drop.

-

Rents Will Rise: There are not enough homes in Cedar Rapids to accommodate all of the buyers. As a result, demand for rentals will increase throughout 2022 and into next year. Rents have already increased 15.6% over the last year, and today’s indicators suggest rents will increase at a faster pace over the next 12 months.

-

Interest Rates Will Rise: The latest consumer price index report showed one of the highest rates of inflation the United States has seen since 1981. To combat inflation and weaken the dollar, the Fed is expected to increase interest rates even further. While the number of points interest rates will increase is still up for debate, it’s only a matter of time until the move is made. As a result, the cost of owning a home in the Cedar Rapids real estate market will increase accordingly.

Should You Invest In The Cedar Rapids Housing Market?

The Cedar Rapids real estate investing community has adapted to a constantly evolving marketplace for years, and the last 12 months have been no exception. Just a few years ago, investors in Cedar Rapids were focused primarily on rehabs and flips. Profit margins remained intact despite years of appreciation, and distressed homeowners provided enough inventory to run a viable investing business. Fast forward to today, however, and the market looks completely different.

Since the Fed introduced lower rates to combat inactivity in the first quarter of last year, demand has increased exponentially. More buyers than anyone could have imagined began actively participating in the market to take advantage of historically low borrowing costs. Today, the average commitment rate on a 30-year fixed-rate mortgage is just under seven percent, according to Freddie Mac. While up year-to-date, rates are still attractive enough to encourage more buyers to go shopping.

Demand created by lower borrowing costs greatly outweighed supply; there are too many people looking to buy and not enough homes. As a result, homeowners have increased their prices accordingly. Since rates initially dropped, the median home value in Cedar Rapids has increased 25.6%; that’s in addition to the previous eight years of appreciation seen in Cedar Rapids. Suffice it to say: real estate in Cedar Rapids is growing more expensive by the day. In just one year, real estate in Cedar Rapids has appreciated an average of 11.8%.

Where rehabbing once reigned supreme, long-term rental properties became the new norm. Investors began trading expensive rehabs for long-term rentals as soon as prices got too high. For starters, the profit margins on flips weren’t where they used to be, and investors were taking on too much risk with how much the market had appreciated. Secondly, interest rates are still low enough to help offset acquisitions acquired through traditional mortgages. With rates just under seven percent, investors can increase their monthly cash flow from properties placed in operation. If for nothing else, lower monthly mortgage payments mean investors get to retain more of the rent they collect.

Cedar Rapids’ price-to-rent ratio is leaning in favor of local rental property owners. At 17.69, the local price-to-rent ratio suggests it is more affordable to rent a home in the Cedar Rapids real estate market. The resulting affordability should both attract more renters and increase competition. Not unlike how competition drove up home values, demand for rental units will allow rental property owners to raise prices. At the same time, demand should mitigate the risk of vacancies, making the prospect of owning a rental property that much more attractive.

To be clear, the Cedar Rapids real estate investing community still has the opportunity to flip homes. This is because the city, as a whole, is still relatively affordable compared to its national counterparts. However, new indicators created in the wake of the Coronavirus have made rental properties more viable than ever, and it’s time investors considered adding them to their own portfolios.

Summary

The Cedar Rapids real estate market has endured a particularly rough stretch, not unlike everywhere else. The pandemic threatened to end nearly a decade’s worth of progress in one fell swoop. Nonetheless, real estate in Cedar Rapids has endured. There are still plenty of obstacles that need to be overcome, like the Fed tightening and a distinct lack of inventory, but the path is more clear than ever. In the event Cedar Rapids is able to navigate the current market, it could come out on the other end stronger than ever.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

Sources

https://www.zillow.com/home-values/394447/ia/

https://www.zillow.com/research/data/

https://www.freddiemac.com/pmms

https://www.redfin.com/news/data-center/

https://www.sofi.com/learn/content/foreclosure-rates-for-50-states/

https://www.attomdata.com/news/market-trends/foreclosures/attom-august-2022-u-s-foreclosure-market-report/

https://www.rent.com/iowa/cedar-rapids-apartments/rent-trends

https://www.bls.gov/eag/eag.ia_cedarrapids_msa.htm

https://www.census.gov/quickfacts/fact/table/cedarrapidscityiowa/PST045221

https://www.realtytrac.com/homes/ia/linn/cedar-rapids/