Key Takeaways

- Distressed debt describes the process through which a homeowner defaults on their mortgage payments.

- One of the main benefits of buying distressed mortgages is the opportunity to purchase property at below market value.

- There are at least five main distressed property types that every investor should become familiar with.

If you haven’t heard of distressed property investing before, now is the perfect time to learn. Distressed properties serve as the source of some of the best deals to be had on the market, and can be found in many different forms. Read on to learn about what can lead a property to become distressed, different types of distressed properties, and how to invest in distressed property listings.

What Is Distressed Debt?

Distressed debt most commonly describes a scenario in which a homeowner defaults on their mortgage loan payments, and thus their property becomes distressed. There are several other ways that a homeowner can encounter distressed debt, such as not being able to pay off their loan by the time it reaches maturity, becoming delinquent on property taxes, or getting condemned due to disrepair. These are all examples of legal and financial circumstances that have a negative impact on the state of the property. Read on to find out additional circumstances that can cause properties to go into a state of distress.

Why Do Properties Go Into Distress?

-

Separation or divorce: One of the most common circumstances that can result in a distressed property for sale is a divorce or legal separation. If both individuals are motivated to sell the property quickly because of legal, financial or emotional reasons, they will often price the property to sell.

-

Death in the family: Although unfortunate, there are some cases when one of two homeowners will pass away, and the remaining individual will no longer be able to make mortgage payments. This can result in a quick property sale for below market value in order to help avoid defaulting on the mortgage loan, and thus, foreclosure. In the case of a single homeowner passing away, there are times when the relatives do not want to bear the burden of managing a vacant property. This can result in the property being sold through a probate or estate sale.

-

Relocation: Homeowners relocated due to personal circumstances are often incentivized to sell their home quickly in order to avoid having to make two mortgage payments at once.

-

Financial: There are a myriad of reasons for which an individual’s financial circumstances can change, thus causing them to default on mortgage payments. This type of distressed seller is quite common, and often very willing to negotiate a deal so that they may avoid foreclosure.

-

Disrepair: A distressed property can often show signs of disrepair due to neglect or even vandalism. Because of the significant investment required in renovating properties in disrepair, investors can often purchase them at a reduced list price.

-

Mid-construction: Similar to the point above, distressed properties left at mid-construction can also be acquired at deeply discounted prices. For example, an investor may purchase a property and start to renovate it, but then run out of funds. This investor may then put the property up for sale at a discount with the hope of recovering some losses.

-

Dispute: Property renovation projects can sometimes fall through at a midway point due to disputes, such as between two partners, or an investor and their lead contractor, to name a few examples. Similar to the example above, the financing investor may then sell the property below market value to recover some of their losses.

-

Bank-owned: A distressed property that has been foreclosed upon is then repossessed and sold by the financial institution that originally financed the mortgage. At this stage, the property is then referred to as a bank-owned or REO (real estate-owned) property. Because maintaining and managing vacant properties is expensive, banks are motivated to move properties very quickly, thus at a favorable price. Buying distressed property in the form of bank-owned or REO properties can be done by visiting various banks’ websites or online portals.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Benefits Of Buying Distressed Mortgages

There are significant benefits associated with buying distressed mortgages, explaining why identifying distressed seller leads can be such a popular topic in the investing community. Often in need of repairs and improvements, distressed properties can be purchased at below market value. Investors have the opportunity to increase property value through renovations by re-listing the property at a higher price upon project completion. If the current tenants have already vacated the property and revoked their rights, an investor can quickly screen and select tenants, allowing them to earn rental income as soon as possible. Due to strenuous personal circumstances, owners of distress properties are often motivated to sell the property as quickly as they can. This provides investors with leverage in the negotiation process, allowing room for potential price reductions.

Distressed Property Types

Although the reasons that can cause a property to go into distress are numerous, they are placed into five main categories. As an investor, it is important to understand the difference between each distressed property type, as the search and acquisition strategy will vary from type to type. The following lists the five distressed property types that will be expanded upon in each of the following sections:

- Abandoned & vacant homes

- REO properties

- Pre-foreclosure & foreclosure properties

- Short sale properties

- HUD homes

Abandoned & Vacant Homes

Abandoned properties are just what they sound like: properties that have been vacated and abandoned by their homeowners. A method of identifying abandoned properties is to drive or walk around your market and look for signs of abandonment. This could be anything from overgrown weeds and broken windows to accumulated mail and garbage. Once you have found an abandoned property, you can contact your title company to identify the owner and their current mailing address. Because the property has been abandoned, there may be opportunities to negotiate a creative seller financing deal. From there it is up to the investor to decide on the best exit strategy based on the property type and location.

REO Properties

Properties that have been repossessed by the banks are known as REOs or bank-owned properties. Once a property has been foreclosed upon, the financial institution that financed the mortgage will gain back possession of the property. Because vacant properties represent opportunity costs and are also expensive to maintain, banks are incentivized to sell properties off as soon as possible. The banks typically sell their properties through an auction first, after which any remaining properties are sold by agents.

Pre-Foreclosure & Foreclosure Properties

When dealing with a distressed property, it is important to note the difference between the pre-foreclosure and foreclosure phases. When an owner defaults on their mortgage payments, they receive a Notice of Default (NOD) from the lender. At this juncture, the property enters a state of pre-foreclosure. The owner is typically given three months to remedy the delinquency, but if they fail, they then receive a Notice of Sale (NOS.) The receipt of the NOS marks the beginning of the foreclosure process, after which the property can be repossessed by the bank to be auctioned off. Investors will often negotiate with homeowners during the pre-foreclosure phase, as they are incentivized to avoid getting foreclosed upon. If a property has already been foreclosed upon, properties can be acquired by attending foreclosure auctions.

Short Sale Properties

Short sales refer to the process through which both the homeowner and the lending institution agree to sell a property, after the homeowner provides proof of financial hardship. Short sales can be thought of as a win-win, because they provide an alternative route against foreclosures, and also allow the lender to recoup some losses.

HUD Homes

HUD homes are properties that are foreclosed upon and sold by the U.S. Department of Housing and Urban Development. When a property is financed by an FHA-backed loan, and that property goes into default, it can be foreclosed upon by the government agency rather than a private institution. HUD properties are sold online through a bidding process through the HUD Home Store to members of the public, as well as government and non-profit organizations. It should be noted, however, that a licensed broker or agent must submit purchase bids on behalf of private buyers.

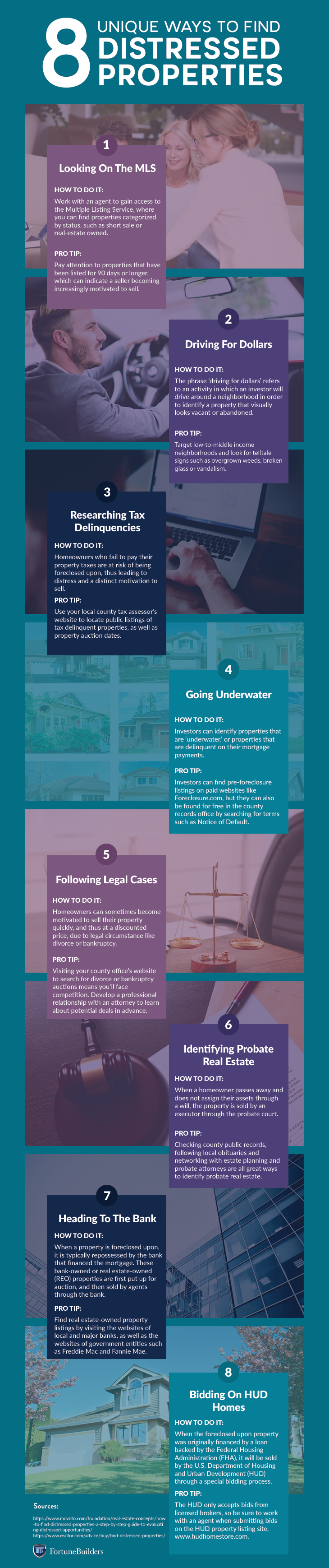

How To Find Distressed Property Listings

Now that the question of ‘what is a distressed property’ has been answered, and different types of distressed properties have been discussed, it begs the question of how exactly one should go about finding distressed property listings. Whether your tactic may be looking for a distressed property for sale by owner (FSBO) listing, or searching through public records, establishing a measured strategy is imperative. Start formulating yours by exploring the unique strategies illustrated in the infographic below. For a more detailed explanation on how to identify distressed properties, be sure to check out our comprehensive guide.

If forced to boil down the topic of distressed property investing into one takeaway, it should be that investors have countless opportunities to identify properties to be purchased for below market value. It takes a unique savviness to identify, target, and negotiate deals with motivated sellers, but the potential payoff can be well worth the effort.

Did you ever encounter a distressed property without even knowing it? Share your experience in the section below.