If you’re a busy real estate investor managing a portfolio of rental properties, it might be tempting to let administrative work fall to the wayside. For instance, bookkeeping tends to take the back burner for entrepreneurs who don’t particularly enjoy filing receipts or reconciling expenses. However, setting up a strong rental property accounting system is a must to run a well-oiled real estate business and make sure you get the most out of your investments. Furthermore, learning accounting basics and setting up an efficient accounting system early on will give you the time to focus on profit-making activities.

Rental Property Bookkeeping 101

Before getting started, it’s helpful to understand bookkeeping and accounting functions and how they are related to one another. Bookkeeping is the recording of financial transactions for individuals or businesses. These records are what entrepreneurs can use to analyze the financial performance of their business, otherwise known as accounting.

When managing a portfolio of rental properties, you will want to ask yourself some of the following questions: how will you manage the constant flow of rent checks, management fees, and maintenance invoices? How do you know which of your properties are eating into your profits? Staying on top of your bookkeeping is the solution to safeguarding your business and maximizing your financial performance. Below are the steps for setting up a solid bookkeeping system for your rental properties. Be sure to familiarize yourself with the benefits of real estate bookkeeping so that you can fully get yourself on board.

-

Separate your personal and business accounts

-

Set up individual accounts for each property

-

Implement a system for tracking your income and expenses

-

Choose between the cash or accrual accounting methods

-

Take advantage of accounting technology

-

Prepare for fluctuating expenditures

-

Learn how to fill out tax forms correctly

-

Add a tax professional to your team

[ Want to invest in rental properties but don't know where to start? Click here to see JWB Real Estate Capital's full-service solution for a truly stress-free investing experience. ]

Separate Personal And Business Accounts

Set yourself up for success by separating your personal and business finances with proper rental property bookkeeping. Open financial accounts for your business, such as checking and savings accounts, credit cards, and debit cards. This separation ensures that all the income and expenses flowing in and out of your business don’t mix with your personal affairs. In addition, creating savings accounts is an important tool for earmarking future rental property expenses, such as capital expenditures and vacancies, as well as holding on to security deposits.

Differentiate Property Accounts

As you grow your business, be sure to open separate accounts for each rental property that you own. By doing so, your income and expenses will be kept separate on a per-property basis. By avoiding commingling, your life will be much easier when it comes time to reconcile, prepare profit and loss statements, and file taxes. In addition, keeping your financial data unique to each property will allow you to identify any particular properties or units that are eating into your rental income.

Track Expenses

Once you have set up separate accounts for each of your properties, you will be ready to start tracking your expenses. First, you will need a reliable system for tracking the inflows and outflows of cash for your properties and your business overall. Some business owners might design their own expense worksheets, while others will elect to use rental property accounting software to keep track of their finances.

Use Cash Or Accrual Method

Another important step in setting up your rental property expense tracking is to decide whether you will implement the cash or accrual method of accounting. If you prefer to record income and expenses as they occur, you should use the accrual method regardless of when the cash is received or paid.

Alternatively, you can use the cash method if you prefer to log income and expenses as they hit your account. Larger organizations use accrual accounting to provide a better picture of income and expenses over periods of time. However, if you’re a small business with restricted cash flow, you may prefer to use the cash method so that you can see exactly how much cash you have at any given moment.

Deciding which method to choose is dependent on your personal preference and what works best for your business. However, the most important thing is staying consistent and sticking to one accounting method when recording your transactions.

Go Digital

It is strongly encouraged for business owners to go digital for all things accounting and bookkeeping. This includes the use of scanning applications to digitize receipts and invoices as they cross your desk (or even while you travel) or investing in accounting software to integrate your bookkeeping, file storage, and financial analysis in one place.

Digitization will help you declutter your office, stay on top of your invoicing and even contribute to saving the planet. If you’d like to share data with professionals across your team, cloud-based software may be your best option. Visit this resource for recommendations on the best financial software for real estate investors.

Automate Accounting Tasks

Owning and operating a profitable rental property portfolio requires many things, not the least of which are systems. Systems are designed to make things easier on investors and enable them to make success habitual. That said, it’s entirely possible to implement systems into mundane accounting tasks. Therefore, investors should find the most efficient ways to automate their accounting needs.

Experts at WP Dev Shed advise “as much as possible, automate. Accounting is challenging enough. You should keep it as simple as possible. Enable automatic payments for the costs whenever possible”. Everything from automatic payments and withdrawals to reminders can be automated. Consequently, anything that can be automated (and trusted) should be automated. Small tasks should be automated; everything that can free up your time will make rental property accounting easier and more accurate.

Prepare In Advance

An important application of rental property accounting is the use of past data to forecast future expenses. To prepare for fluctuating or unexpected expenditures, disciplined landlords and investors, will set aside a set percentage of their rental income into savings each month. For example, do you know what you will do when maintenance costs increase sharply in the winter? How will your cope when several appliances need to be replaced at once? Setting aside these savings provides a buffer against derailing your finances. Over time, your historical financial data will help you forecast these costs with greater accuracy.

Understand Tax Forms

It is recommended that you get a working knowledge of applicable tax forms as soon as you start your business. Doing so will make rental property bookkeeping a lot easier and more accurate. For example, W-9 and 1099 forms are required from every employee and non-employees that do any work for your business. A W-9 form documents a contractor’s tax ID number and their type of business. A 1099 form will be additionally required for non-employees who made over $600 from your real estate business within a calendar year.

Learning what basic tax forms are used for what purposes will help your onboarding and bookkeeping processes run more smoothly. For now, a basic overview of W-9 and 1099 forms will be helpful, but be prepared to learn more about these requirements as you run your business. These forms will be necessary come tax time, and the penalties for not filing correctly are expensive. Make sure to understand the basics of taxes as soon as possible by talking to a tax professional.

Hire A CPA

Consulting specialized professionals in areas outside your expertise is the only surefire way to safeguard your business. A certified public accountant (CPA) is a great addition to your team of experts, as they will advise you on how to implement accounting systems, educate you on best practices and help you analyze your financial performance. They will also serve as your guide when preparing and filing your taxes.

Rental Property Income vs. Expenses

There are multiple types of rental income and rental expenses. We’ll start with the fun stuff first, which is the money that we bring in from our rental properties known as income. Rental property income can come in many forms, the most common being rent payments and prepaid or prorated rent payments. Income can also come in the form of fees, such as late rent fees, termination fees, pet fees, or appliance rental fees. Finally, a security deposit can be considered income, but only if all or part of it is being used to repair for damages caused by the tenant.

On the flip side, you will also incur expenses when operating a rental property. Common expenses include routine maintenance, repairs, paying outside vendors for landscaping and other services, and the tools required to maintain the property. Some landlords will also pay for the utilities of the property, which would count as an expense. There are also expenses related to the cost of doing business, such as marketing expenses, property management fees, accountant or attorney fees, and any other professional services that you may hire. Finally, the landlord is required to pay the mortgage, the property tax and insurance, and any other fees related to their mortgage or loans. All of these are expenses that the landlord must pay for and keep records of.

What Is Schedule E?

Schedule E is a tax form that rental property owners fill out to report their profit or loss for their rental property. You will also need to match your expenses to the correct category on this form provided by the IRS, or at least the closest related expense category possible. This form will keep you compliant with IRS standards, as well as give you a formal place to report your income and expenses for the year. This form will be used to calculate your owed taxes for that tax year.

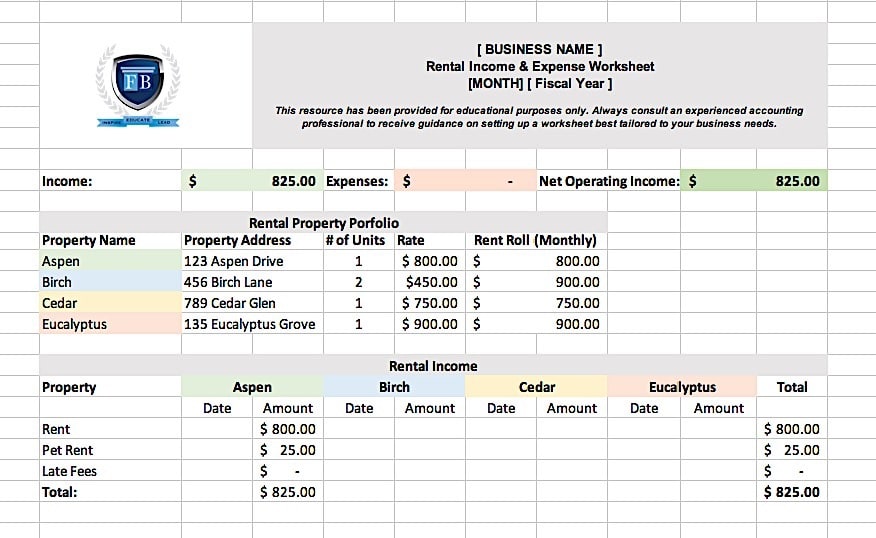

[Downloadable] Rental Property Expense Spreadsheet

Hopefully, by now, you understand the benefits of organizing your rental property finances, as well as separating income and expenses for each property in your portfolio. To get started, you can either set up your own rental income and expense worksheet or rely on a system provided by the software of your choice. Regardless of your preference, it’s beneficial to practice on a template so that you can internalize the basics of proper bookkeeping.

Download this rental property expense spreadsheet template to help you set up your rental property bookkeeping today.

Rental Property Accounting Apps

Many different tools and apps exist solely to help improve your accounting systems. Some are designed specifically for real estate investors and property owners, and others are broader, but they can all benefit you greatly.

-

Quickbooks is one of the most well-known and trusted pieces of software worldwide. It can be used for any business but is extremely helpful with tracking rent payments, maintenance bills, contractor fees, etc.

-

Stessa is a favorite among real estate investors because it was designed just for them. This app allows users to track finances and documents for all of their properties in one place. It can even track investment performance and create reports on cash flow and revenue. Some unique features include a tenant ledger, receipt scanning, tax prep, and more.

-

Appfolio is not solely an accounting program, it is useful for property management as a whole. Users can keep track of tenants, payments, and work orders, while also automating late fees and tracking deposits.

-

Buildium is similar to Appfolio in that it is a full-fledged platform for property management. This app offers accounting features such as corporate financials, accounts payable, and payment tracking.

-

RentRedi helps property owners streamline their accounting. For instance, the platform automatically syncs properties and charges from the account, and imports transactions automatically from debit and credit cards. You can view profit and loss, cash flow, and balance sheets by property while tracking income and expenses with ease.

Summary

Rental property accounting, when done correctly, brings about valuable benefits for any business owner. Advantages include safeguarding your business against debt or fraud, forecasting future expenses, and saving time and resources during tax season. Rental property owners can use bookkeeping to their advantage to track the financial flows for each property so that they can fine-tune their operations.

If you are an investor with an LLC, you may enjoy additional accounting principles and tips. As always, consult a financial professional to help you implement financial tracking the right way for your business. And remember: accounting is just one example of many real estate systems that will help you maximize efficiency and minimize errors, so you can channel your energy into activities that will boost your bottom line.

Start generating passive income with single-family rental properties!

If you're interested in investing in real estate, but don't have the time or experience to start, click the banner below to see JWB Real Estate Capital's full-service solution for a truly stress-free investing experience.

The information presented is not intended to be used as the sole basis of any investment decisions, nor should it be construed as advice designed to meet the investment needs of any particular investor. Nothing provided shall constitute financial, tax, legal, or accounting advice or individually tailored investment advice. This information is for educational purposes only.