The ability to evaluate deals is crucial to the success of any real estate investor. Whether you are deciding if you should move forward with a deal or simply evaluating an existing property, a thorough rental property analysis is key. Luckily, with the right rental property calculator, making those choices becomes easier. So if you want to find the best investment properties with the most attractive profit margins, try using the following calculations to analyze your next deal; you might be surprised by what they can help you predict.

[ Want to invest in rental properties but don't know where to start? Click here to see JWB Real Estate Capital's full-service solution for a truly stress-free investing experience. ]

Earning Income From Rental Properties

Rental properties have become synonymous with today’s greatest wealth-building vehicles. Few (if any) exit strategies have proven to be more lucrative over long periods of time than investing in rental properties. If for nothing else, the wealth generated from rental properties can be extrapolated over a lifetime and even generations. As long as a rental property is placed in service, it can generate cash flow. It is entirely possible, in fact, for the cash flow generated from a rental property to pay off monthly mortgage operations, and then some. Therefore, landlords may simultaneously pay their mortgage with someone else’s money and pocket a little profit each month. Additionally, each payment made on the mortgage will increase the owner’s equity in the property.

It is worth noting, however, that income isn’t limited to cash flow and equity. Owners may increase their profit margins by using rental properties as a tax shelter. Thanks, in larger part, to several tax benefits awarded to rental property owners, qualifying investors may be able to lower their taxable income each year; that means the government will take less out of their pocket each year. While not technically income, a penny saved is a penny earned. Something like rental property depreciation can save investors thousands of dollars over the life of a property; money that can make or break n investment.

Investment Property Analysis: 8 Factors To Consider

A thorough rental property analysis will provide insights into a given deal’s potential profitability; that’s why it is crucial to know which indicators to look for and consider. Here are eight crucial factors for your next rental property cash flow analysis:

-

Location: You can change a lot about a property, but you can’t move it to another neighborhood. The rental property’s location will influence its desirability and your ability to keep vacancy rates low. When deciding on an area, pay attention to market factors, and don’t be afraid to shop around.

-

Income And Cash Flow: Income refers to the amount of rental income generated, while cash flow represents the net amount of cash being transferred into and out of a property. These indicators can help investors determine whether or not a property will be profitable.

-

Property Type: Property type refers to the number of units and type of house you are looking at. Examples include single-family homes, multi-family homes, duplexes, apartments, townhouses, condos, and more. Each type of property will come with unique advantages and disadvantages, so be sure to weigh the pros and cons of each property in your area.

-

Ideal Tenants: Tenants are where most of your income is generated when investing in rental properties, which is why the right tenants are crucial to your success as a real estate investor. Meet with the current owners of a property and ask if they have any problems with the existing tenants. It will also benefit you to tailor your marketing techniques and prepare appropriate rental applications to attract reliable tenants.

-

Vacancy Rates: Vacancy rates are determined by looking at what portion of the year a property does not have tenants. A perfect vacancy rate would be zero percent, meaning the property generates rental income throughout the year. While it is not impossible to have a nonexistent vacancy rate, factor in the possibility of vacancies when calculating possible rental expenses.

-

Rental Strategy: Decide whether you are focusing on short- or long-term rental properties, which will influence the types of homes and areas you should invest in. A long-term rental property is a more traditional rental property involving leases and long-term tenants. Short-term rentals are typically thought of as vacation homes or Airbnb rentals. Both can yield attractive results, depending on your target real estate market.

-

Operating Expenditures: Operating expenditures are any ongoing costs of running a rental property. They include maintenance costs, equipment, insurance, utilities, and any other operational costs. To determine operating expenditures, add up maintenance costs, property management fees, and other costs of running the property.

-

Capital Expenditures: Capital expenditures refer to issues that need to be taken care of periodically, but not as frequently as operating costs. Physical assets such as property, industrial buildings, or equipment could be counted as capital expenditures. To better understand the differences between capital and operating expenditures, check out this in-depth analysis.

How To Use A Rental Property Calculator

A rental property calculator works by relying on certain variables to determine the potential performance of the investment property. For example, investors should gather as much information as possible about the property (like the purchase price and property value). Investors should also be ready to estimate a few numbers based on their information, such as the vacancy rate and rental price.

You can also determine the amount of money you will make if you plan on selling the property. You can do so by calculating the property’s appreciation over the time you have owned it. Then, determining the holding length of the property, which is the amount of time you owned it, and the selling price of the property.

Read through the following list of variables to help you get started calculating rental income today:

-

Current Property Value: The current property value is how much the property in question is currently worth. Investors should not take the purchase price at face value and instead hire a professional appraiser to complete a report. The property value will help you determine a number of calculations and even help with your purchase negotiations.

-

Total Cash Investment: This refers to the number of cash investors put towards the property, including the down payment and any renovation costs. When considering a down payment, Rasti Nikolic, a Financial Consultant at Loan Advisor, advises that “investors must think about the percentage they are willing to pay for a property” and suggests that a sufficient amount should be between 20% and 25% of the property price. Investors who purchase a property in all cash could therefore include the entire purchase price.

-

Closing Costs: Lender, notary and attorney fees are all included in the total closing costs. These also refer to costs incurred during the title search, property transfer, and loan origination. Closing costs typically range from two to five percent of the total purchase price.

-

Mortgage Rate: A mortgage rate is simply the interest rate for the loan used to finance the property. If you have not yet purchased the property, this information should still be available by consulting your lender with the necessary information.

-

Loan Term: Loan term refers to the length of a given loan. On average, a rental property loan term could range from 10 to 25 years. The loan term will help when calculating operating costs and more.

-

Rental Yield: Rental yield is the anticipated monthly rent from an investment property. Include any income generated from monthly rent payments, parking permits, laundry services, or other cash flow from the property. If you are unsure of the current rental yield (per the seller), use market research to help make an accurate estimate for the property.

Once you have some basic information on the rental property, you can rely on a rental property analysis calculator to estimate the profitability automatically. A wide array of rental property analysis software can assist you during this process. Depending on which calculation you are trying to determine first, you can search online for different rental property calculators. This rental ROI calculator provided by SparkRental is a great place to start, as well as this annual cash flow calculator by Calculator.net.

If you do opt to act as your own rental income calculator, there are several formulas you can rely on to help. Create a rental property analysis spreadsheet using Microsoft Excel or Google Sheets—depending on what you are comfortable with—and prepare to start your calculations. Whether you choose an online rental calculator or pen and paper, be careful to determine the above variables to ensure your deal analysis is as accurate as possible.

When To Use A Rental Property Calculator

Investors should use a rental property calculator to analyze potential deals or evaluating existing rental properties. While a rental property calculator is not required for making sound investment decisions, it can provide insights into the potential or current profits of a property. Investors who employ a rental property calculator when deciding whether to invest in a given property can avoid costly mistakes. On the other hand, investors who rely on a rental property calculator to evaluate existing properties can determine if it is time to sell or reorganize.

Investment property calculators help evaluate almost any property type, ranging from single-unit homes to multi-unit apartment buildings. These calculators are not exclusive to first-time investors either! Any investor, regardless of experience, can use the calculations to help make accurate predictions on potential rental yield and so much more. Also, investors who are selling a property can pass on the findings from their rental property calculations to the buyer to speed up and improve the sale. Remember, the right rental property calculator can effectively guide you through both buying and selling an investment property.

What Is A Good ROI For A Rental Property?

ROI in real estate stands for “return on investment,” otherwise known as the number of profits investors can expect to receive from a rental property. While a good ROI will vary from investor to investor, some ranges can be used as general guidelines. An ROI between five and 10 percent is solid for most rental properties. Going up from there, an ROI of over 10 percent typically represents a great investment opportunity. When a property has an ROI below five percent, it is generally not considered a worthy investment.

As you consider the ROI on a rental property, remember to pay careful attention to each variable you consider, such as the vacancy rate, operating costs, and more. Keep in mind that it is better to err on the side of caution when estimating the potential ROI. You don’t want to overestimate a 10 percent ROI, jump on the deal, and then struggle with the property.

Pay attention to vacancy rates and repair costs, while being cautious with your estimates. In some cases a low-end property may seem to have a great ROI but when you add in renovations, the potential profits decrease significantly. By identifying accurate numbers and leaving yourself some wiggle room, you can help ensure your estimates are as close to reality as possible.

What Is The 2% Rule?

The 2% rule is essentially a justification for whether a rental property is worth investing in. More specifically, however, it’s this rule that “sets the bar” for the investment. The 2% rule will tell prospective investors if a property’s cash flow potential warrants its impending acquisition costs. As its name suggests, investors want to see the investment generate at least 2.0% of the asset’s purchase price each month in cash flow.

[ Want to invest in rental properties but don't know where to start? Click here to see JWB Real Estate Capital's full-service solution for a truly stress-free investing experience. ]

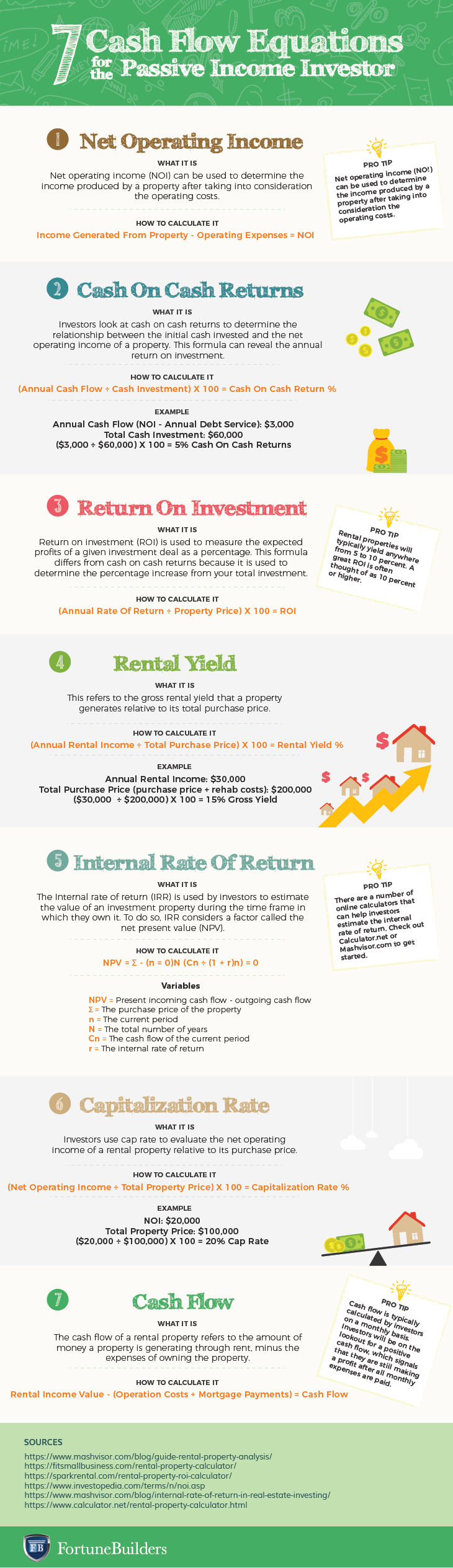

7 Cash Flow Equations For The Passive Income Investor

In order to calculate cash flow for a given property, there are several formulas investors will want to be familiar with. While these calculations may seem overwhelming at first, understanding how to calculate rental income and more is crucial for any deal analysis. Here are seven cash flow equations investors can use when evaluating a property:

-

Net Operating Income

-

Cash On Cash Returns

-

Return On Investment

-

Rental Yield

-

Internal Rate Of Return

-

Capitalization Rate

-

Cash Flow

1. Net Operating Income

Net operating income is the amount of income generated after operating costs have been taken into account. The formula is simple: take the generated income and subtract the total operating costs. Remember to take the time to accurately assess the expected operating costs, which include anything it takes to maintain regular operations. This will help provide a better idea of the potential profitability of a given deal.

2. Cash On Cash Returns

Cash on cash returns helps contextualize the overall potential of an investment by taking the annual cash flow and dividing it by the total cash investment. Essentially, this formula looks at the profits generated in one year in relation to the total loan payments made during that same year. Calculating cash on cash returns is helpful when looking at the return on investment of a given property.

3. Return On Investment

The return on investment, or ROI, is one of the most common terms used in real estate. ROI shows the expected profits of a given deal as a percentage and is relatively simple to calculate. This makes it an easy point of reference for investors analyzing deals. To calculate the ROI of a property, take the estimated annual rate of return, divide it by the property price, and then convert it into a percentage. Rental properties are known to yield anywhere from five to 10 percent, with some investments even going above ten.

4. Rental Yield

Rental yield is the gross rental income a property generates in relation to the investment’s total purchase price. It can be determined by dividing the annual rental income by the total purchase price and is always converted to a percentage. The rental yield can help determine the long-term viability of a given investment. For example, if the rental yield is negative or even, the investment will either cause investors to lose money or break even. A good rule of thumb for rental yield is to look for properties at or above seven percent.

5. Internal Rate Of Return

This is where many investors get lost, so remember, resources online can help with this calculation. The internal rate of return (IRR) is used to determine the value of an investment during the time of ownership. It is yet another method used to decide whether or not an investment is desirable. The formula requires several variables, including the purchase price, cash flow of the current period, length of the current period, and the net present value. In most cases, a higher IRR signals the potential for greater cash flow from an investment.

6. Capitalization Rate

The property’s cap rate is used to calculate the expected returns of an investment. While it is most commonly used in commercial real estate, residential investors may find it useful, particularly when evaluating risk. A high cap rate typically correlates with a higher level of risk, while a low cap rate can signify lower levels. To determine the capitalization rate, investors must divide the net operating income by the total property price. The final value will be expressed as a percentage.

7. Cash Flow

Cash flow is the amount of money an investment generates each month through rent after considering the property’s expenses. The formula is relatively easy to get down: subtract the operation costs and mortgage payment from the total rental income value. Most investors look at this metric monthly, so consider that as you determine your income and expenses. The higher the estimated cash flow, the more an investor stands to make from a given property.

Responsibilities Of A Rental Property Owner

Running a profitable and tenant-acclaimed property will coincide with at least a few universal responsibilities. To be perfectly clear, there are many responsibilities levied on today’s rental property owners, but the following are never left out of the equation:

-

Property Maintenance: Rental property owners are responsible for keeping the property in living condition. That means they will need to contact the appropriate businesses to keep up with maintenance, repairs, renovations and anything else.

-

Filling Vacancies: The worst thing that can happen to a rental property owner is a vacancy. Therefore, finding tenants is one of the biggest responsibilities of an investor.

-

Paperwork: Administrative paperwork is tedious, but it must be done. Everything from filing taxes to signing leases needs to not only be done, but done accurately.

However, it is important to note that owning a rental property can be entirely passive. Enlisting the services of a truly great property manager can alleviate rental property owners from the majority of responsibilities associated with leasing a property. A Third-party property manager can do just about everything for an investor, from finding and screening tenants to keeping up with maintenance requests and rent collection. In fact, it’s the services provided by third-party property managers that make rental property investing so enticing. With their help, investors may not only collect cash flow passively, but they may also increase the holdings in their portfolio without adding additional work to their schedule.

A Landlord’s Responsibilities

One way to maximize your profits as a rental property owner is to manage the units yourself. But, a landlord’s responsibilities are easier said than done. Managing a rental property involves maintaining the property, making necessary repairs, advertising listings, screening tenants, and more. Landlords are in charge of anything required to keep the property up to code.

There are also some administrative responsibilities required of being a landlord. These include paying regular bills, managing utilities, collecting rent, and budgeting. Landlords are also in charge of any paperwork associated with renting, such as creating leases and filing tax paperwork. If these tasks sound like too much to handle, you can utilize property management softwares or work with a property management company.

Summary

No matter where you are in your career as a real estate investor, the right rental property calculator can help guide your investment decisions. If you are evaluating an existing property, emphasize finding accurate numbers. By carefully calculating your property’s performance, you can determine how to move forward. When used correctly, a reliable rental property calculator can enable investors to choose profitable real estate deals and—in turn—boost their portfolios.

Start generating passive income with single-family rental properties!

If you're interested in investing in real estate, but don't have the time or experience to start, click the banner below to see JWB Real Estate Capital's full-service solution for a truly stress-free investing experience.

The information presented is not intended to be used as the sole basis of any investment decisions, nor should it be construed as advice designed to meet the investment needs of any particular investor. Nothing provided shall constitute financial, tax, legal, or accounting advice or individually tailored investment advice. This information is for educational purposes only.